|

9/23/2006

Pay No Attention to the General as "Liberals" Launch Green Energy Fund

:.

A bunch of loving liberals, billionaires, Bill Clinton and a former World Bank president are coming to the rescue! Hooray! The beneficent Democrats, so concerned with the environment, will save us from the ravages of Peak Oil and George Bush and The Legion of Doom, etc.! And it'll be sustainable WalMarts for as far as the eye can see. * sigh *  Former President Bill Clinton bows to former President George H. W. Bush after he receives a honorary degree during the Tulane University Commencement in New Orleans on Saturday May 13, 2006. Former President Clinton also received a degree.(AP Photo/Alex Brandon, Pool) In Peak Oil? How About Anything Into Oil?, I wrote: I'm not saying that a collapse due to energy isn't going to occur, all I'm saying is that if it does, it's by design. They probably found the answer---or, more likely, multiple answers---decades ago. But that's just a conspiracy theory.... The General and the Holy Grail of Energy Storage DevicesAn engineer friend of mine commented on the EEstor device, the "Holy Grail" energy storage technology that's about to make pure electric cars viable on a mass scale. He told me that it sounded like a supercapicitor. Now, it's obviously just an insane, tinfoil hat conspiracy theory that this technology is based on U.S. Patent 3288641, issued 29 November 1966 to---wait for it, this is good--- STANDARD OIL COMPANY. And where is EEstor headquartered? Get out your best, fake cowboy, George Bush accent and say it with me: Texxxxxshuss! It was a simple question: Just how closely is Kleiner Perkins---the venture capital firm behind EEstor---connected to Them? Within two minutes of researching this, I'd seen enough: Colin Powell to join Silicon Valley's Kleiner PerkinsColin Powell, a 33rd Degree Freemason, a former U.S. Army Four Star General, U.S. Secretary of State, National Security Advisor, and Chairman of the Joint Chiefs of Staff happens to go into quiet, semi-retirement working for the venture capital firm responsible for funding the company that is building the "Holy Grail" of energy storage devices, based on technology patented by Standard Oil Company in 1966... In Texas. As always, I ask you: How could anyone possibly make this up? While picking over the bones in the Cryptogon archives, I found another tidbit that might be of interest here. Over a year ago, I wrote this about Peak Oil: I don't know. I see things like the "sustainable" WalMart and the FedEx hub covered with solar panels and I have to wonder if this Peak Oil thing is actually going to be the kill shot that we think it's going to be. (Oh yeah, did you hear the one about the 500 megawatt solar power plant in California?) Maybe They have a much better grip on this thing than we know. Maybe They're ramping up alternatives at a pace that is congruent (or somewhat congruent) with the fall-off of conventional energy sources.

Those of us who despise the present global political and economic order look to Peak Oil with a sense of hope! Yes... Hope. Something tells me, however, we're not going to be that lucky.

Peak Oil probably won't take this thing down, simply because it seems so obvious that it will.

Peak Oil looks real to me and I've made life altering decisions based on my belief that the end of cheap hydrocarbon energy is going to collapse this system. All I'm saying is that if Peak Oil turns out to be a non event, I will not be surprised in the least. While the loving liberals put a public face on the clean, green energy revolution, pay no attention to the former general planting the seeds of the technology that They have had all along: Former President Clinton announced the launch of an investment fund expected to raise more than $1 billion for renewable energy on Friday, the final day of his global issues conference.

The Green Fund would focus on reducing dependence on fossil fuels, creating jobs, lessening pollution and helping to reduce global warming, all while making a profit, Clinton said.

The announcement at the Global Initiative Conference came a day after British business mogul Richard Branson pledged $3 billion to battle global warming,

"The earth is warming at an alarming rate, we are running out of fossil fuels, and it is long past time for us to take action to correct these problems," Clinton said in a statement.

The fund's launch was announced by Clinton, former World Bank President James D. Wolfensohn, Vinod Khosla of Khosla Ventures, Yucaipa Companies founder Ron Burkle and business leader and philanthropist Steve Bing. Wolfensohn will serve as the fund's managing director.

posted by Kevin at 6:07 PM

Cryptogon Reader Signs Up for Hosting with Blue Host!

Thanks to cubapolidata.com for signing up for webhosting with Blue Host via Cryptogon. Cryptogon receives $65! About Hosting with Blue Host via CryptogonI've been hosting Cryptogon on Blue Host for about a year and a half. I've been so impressed with the service that I personally started referring people to them. I know that five of these people went on to sign up for hosting. Here's the bad news: I missed out on $65 EACH time one of these folks signed up for hosting with Blue Host. Here's the good news: I'm now an affiliate, so now I will make $65 each time a Cryptogon reader/fan/supporter signs up for hosting with Blue Host. I searched long and hard for a reliable and reasonably priced host for Cryptogon (after repeated disasters with other hosting companies). Check out Blue Host's features and reputation. You'll see why I went with them. And I don't need to tell you about their reliability. How often has Cryptogon been down over the past year? You, the Cryptogon reader, should know. Exactly! It's never down. (Well, it may have been down once for about two hours, but I don't remember if that was their fault or mine... It was probably mine.) So, if you're looking for the best hosting possible for a reasonable price AND you want to support Cryptogon, it's simple: Blue Host. PLEASE NOTE: Sadly, there is some confusion about how I receive Blue Host referral payments. IN ORDER FOR ME TO RECEIVE CREDIT, YOU MUST CLICK ON ANY OF THE LINKS TO BLUE HOST FROM CRYPTOGON.COM AND SIGN UP FROM THERE. If you just go to Blue Host, without clicking a link from Cryptogon, and sign up, I won't and can't get credit for it after the fact. So far, this has happened twice. It's my fault for not making this explicitly clear in the first place. Sometimes, computer people, like me, assume things that shouldn't be assumed. This was one of those cases.

posted by Kevin at 5:36 PM

Bubble: A 24-Year-Old and $2.2 Million Worth of "Liar Loans"

:.

Man, it's going to be interesting... Casey Serin is a 24-year-old Sacramento man who bought seven properties in four states within the first three months of 2006. Even after selling a home in Utah a few weeks ago, he's $2.2 million in debt and will be four months behind on all of his mortgages come October.Via: Housing Panic

posted by Kevin at 3:38 PM

9/22/2006

Gentlemen, Stop Your Engines

:.

Forget hybrids and hydrogen-powered vehicles. EEStor, a stealth company in Cedar Park, Texas, is working on an "energy storage" device that could finally give the internal combustion engine a run for its money -- and begin saving us from our oil addiction. "To call it a battery discredits it," says Ian Clifford, the CEO of Toronto-based electric car company Feel Good Cars, which plans to incorporate EEStor's technology in vehicles by 2008.

posted by Kevin at 1:06 AM

9/21/2006

Oil Back Around $60: Deploy Tinfoil and Watch Out

WARNING: The following is not a recommendation to buy, sell or hold any financial instrument. Well, well, well... It might pay to revisit my Investing Very Close to Home letter to a Cryptogon reader, written back in July: I don't see gold being a cure-all, but who knows!? It might go to ______ <- fill in the blank. Consider nibbling the dips under $600? That would be my best guess, if I was forced to make a guess.

...

Oil? It could just as easily go to $45 before it goes to $200. I wouldn't go near oil, long or short. It's far too volatile. $60 is a critical support on oil; the gateway to $45. Gold has totally broken down. See my extended piece on the fallacy of gold. Anyone who is relying on gold for wealth preservation is acting on faith alone at this stage. Any asset with this kind of volatility isn't an investment, it's a gamble. For the tinfoil hat traders, people with money to burn, gamblers, speculators, and other associated loose units, the following is for you: If the support at $60 holds on oil, watch out for a weird upside move. If anything happens in the Persian Gulf in the near future, these relatively low oil and gold prices are where the Them took their long positions... before the LIVE BREAKING NEWS on CNN, etc. and Bush mumbling something about Iran and freedom in an address to the nation. If I was a trader, which I'm not anymore, I would be looking for excuses to be long oil from these levels; maybe the longest, out of the money contracts available, i.e. the cheapest to play. Consider drop dead stops on long positions at $58, rather than $60 because a break below $60 may overshoot short. This theory is probably wrong if oil goes below $58. Again, look for reasons to go with a long bias here. As usual, it's not easy. If you look at an oil chart, it could be argued that you're "Trying to catch a falling knife" by going long here. This is doing the opposite of the better known, "The Trend is Your Friend" strategy. But, look at a longer term chart and you might just be "Buying the dip" of a larger uptrend. This is why I don't trade. But I smell a rat on this recent downward price action on oil. It's nothing scientific. It's probably not correct. But I smell a rat anyway. If anything "big" happens, we will see $100 oil within a couple of trading sessions. If there's one thing I've learned in all my years of watching financial markets, the Big Money never chases the move, and They look for (and create) opportunities to make the most money. They're in before the action takes place. (See the accumulation phase of Dow Theory.) And They're out as clarity emerges, and the public emotion phase begins. Hint: Waiting for clarity is not often rewarded. If you believe 5% of what this story says, should oil be trading around six-month lows? Or is this a multi billion dollar set up for the next gap up? The Pentagon's top brass has moved into second-stage contingency planning for a potential military strike on Iran, one senior intelligence official familiar with the plans tells RAW STORY.

The official, who is close to the Joint Chiefs of Staff, the highest ranking officials of each branch of the US military, says the Chiefs have started what is called "branches and sequels" contingency planning.

"The JCS has accepted the inevitable," the intelligence official said, "and is engaged in serious contingency planning to deal with the worst case scenarios that the intelligence community has been painting."

A second military official, although unfamiliar with these latest scenarios, said there is a difference between contingency planning -- which he described as "what if, then what" planning -- and "branches and sequels," which takes place after an initial plan has been decided upon.

Adding to the concern of both military and intelligence officials alike is the nuclear option, the possibility of pre-emptive use of nuclear weapons targeting alleged WMD facilities in Iran. There's also General John Abizaid's recent comments on Iran's capability to disrupt Persian Gulf oil shipments. In terms of The Magic Mystery Dot, we could now be in a large scale drawdown phase after the multiple, smaller MMD upside alerts. How long will the drawdown last? Ahh, that's where the "Mystery" comes in. If all of this seems like incomprehensible rambling to you, that's mostly what it is. If, however, oil suddenly jumps to $100 or more, think about these echoes from the near future that were barely discernible from the $61 per barrel range. I'm putting these ramblings out there in case any of the black box programmers who read Cryptogon (and they do read Cryptogon) are getting similar signals and have anything to add.

posted by Kevin at 8:01 PM

The Strait of Hormuz: Previous Cryptogon Analysis Confirmed by U.S. General

:.

In, The Strait of Hormuz: It's Not That Bad, It's Worse, I wrote: The Iranian strategic military plan for engaging the United States must include crippling oil exports from the Persian Gulf. Iran is (probably) in a position to close the Strait of Hormuz, the most strategically important waterway in the world.

...

This is the good news.

The bad news is that Iran wouldn't have to sink a bunch of vessels in the Strait of Hormuz to bring the whole damn bigtop crashing down.

If the Strait of Hormuz is the most strategically important waterway in the world, what's the most strategically important facility in the world?

Ras Tanura:

As much as 80% of the near 9 million barrels of oil a day pumped out by Saudi is believed to end up being piped from fields such as Ghawar to Ras Tanura in the Gulf to be loaded on to supertankers bound for the west.

If Iran manages to damage the deep water oil loading facility at Ras Tanura...

Well, I hope your bicycle is in good working order. Today, the above, two-month-old Cryptogon analysis was confirmed by U.S. Four Star General John Abizaid: Iran could trigger a global terrorist campaign and choke the West's oil supplies in the event of war with America, the top US commander in the region has warned.

In a rare public discussion of how a war with Iran might unfold, Gen John Abizaid, the chief of the US Central Command, gave a sobering assessment of Iran's military potential.

He warned that in a war Iran would rely on unconventional means to challenge America's superiority.

"Number one, they have naval capacity to temporarily block the Straits of Hormuz [the entrance into the Gulf] and interfere with global commerce if they should choose to do so," he said.

"Number two, they've got a substantial missile force that can do a lot of damage to our friends and partners in the region. General Abizaid doesn't mention Ras Tanura in point number two, I wonder why? ;)

posted by Kevin at 7:50 PM

9/20/2006

Cryptogon Reader Signs Up for Hosting with Blue Host!

Thanks to freemania1.com for signing up for webhosting with Blue Host via Cryptogon. Cryptogon receives $65! About Hosting with Blue Host via CryptogonI've been hosting Cryptogon on Blue Host for about a year and a half. I've been so impressed with the service that I personally started referring people to them. I know that five of these people went on to sign up for hosting. Here's the bad news: I missed out on $65 EACH time one of these folks signed up for hosting with Blue Host. Here's the good news: I'm now an affiliate, so now I will make $65 each time a Cryptogon reader/fan/supporter signs up for hosting with Blue Host. I searched long and hard for a reliable and reasonably priced host for Cryptogon (after repeated disasters with other hosting companies). Check out Blue Host's features and reputation. You'll see why I went with them. And I don't need to tell you about their reliability. How often has Cryptogon been down over the past year? You, the Cryptogon reader, should know. Exactly! It's never down. (Well, it may have been down once for about two hours, but I don't remember if that was their fault or mine... It was probably mine.) So, if you're looking for the best hosting possible for a reasonable price AND you want to support Cryptogon, it's simple: Blue Host. PLEASE NOTE: Sadly, there is some confusion about how I receive Blue Host referral payments. IN ORDER FOR ME TO RECEIVE CREDIT, YOU MUST CLICK ON ANY OF THE LINKS TO BLUE HOST FROM CRYPTOGON.COM AND SIGN UP FROM THERE. If you just go to Blue Host, without clicking a link from Cryptogon, and sign up, I won't and can't get credit for it after the fact. So far, this has happened twice. It's my fault for not making this explicitly clear in the first place. Sometimes, computer people, like me, assume things that shouldn't be assumed. This was one of those cases.

posted by Kevin at 5:11 AM

New Zealand: License Parents?

:.

A high-powered expert group has proposed a kind of "parents' license test" which all parents would have to sit to keep care of their children and to receive child-related welfare benefits.

The proposed assessment, similar to a driver's license, would be administered when a baby was born and repeated when the child turned 1, 3, 5, 8, 11 and 14.

Parents found to have "risk factors" for child abuse, such as domestic violence, drug and alcohol problems or mental illness, would be offered help.

Judge Graeme MacCormick, a former Family Court judge who initiated the proposal, told a seminar in Auckland yesterday that parents who refused to accept help, or to be assessed, should have their child-related benefits suspended and possibly lose their children.Related: New Zealand's Dark Secret

posted by Kevin at 3:18 AM

9/19/2006

Military Coup in Thailand

:.

Tanks and troops patrolled Bangkok early Wednesday after the chief of Thailand's army said the military was taking control of the country.

Police were closing stores and directing traffic off Bangkok streets, residents told CNN via e-mail, but no violence was reported.

The coup against the government of Prime Minister Thaksin Shinawatra is being led by Thai army chief Gen. Sonthi Boonyaratkalin and Thailand's opposition Party of Democratic Reform. Thaksin is in New York for the U.N. General Assembly meeting.

The coup plotters declared martial law and suspended the constitution of the Southeast Asian nation.

"The armed forces commander and the national police commander have successfully taken over Bangkok and the surrounding area in order to maintain peace and order. There has been no struggle," the coup announcement said, according to The Associated Press. "We ask for the cooperation of the public and ask your pardon for the inconvenience."NOTE TO CRYPTOGON READERS:My connection to the Internet is ultimately provided by Thailand's Shin Corporation, over their Thaicom4/IPSTAR satellite. Since Thailand is now under martial law, anything could happen to this connection. If you notice no new posts for a few days, it probably means that I can't get online because of events related to the military coup in Thailand.

posted by Kevin at 1:49 PM

911 Mysteries: Demolitions

:.

This is by far the best film I've seen on the WTC demolitions. If the above site runs out of bandwidth, go with Google Video (while it lasts): 911 Mysteries - Demolitions (Part 1 of 3)911 Mysteries - Demolitions (Part 2 of 3)911 Mysteries - Demolitions (Part 3 of 3)

posted by Kevin at 5:07 AM

DARPA Contract: Learning Complex Human Processes After a Single Example

:.

The U.S. Air Force seems to be taking the lead in terminator brain research at the moment. Keep the Experimental AI Powers Robot Army story in mind as you read this: BBN Technologies, a leading advanced technology solutions firm, has been awarded $5.5 million in funding from the Defense Advanced Research Projects Agency (DARPA) for the first phase of the Integrated Learning Program. Over the next four years BBN will develop an artificial intelligence capability called "Integrated Learner" that will learn plans or processes after being shown a single example. The total value of the effort, if all four years of the development program are completed, could be up to $24 million.

The goal of the project is to combine specialized domain knowledge with common sense knowledge to create a reasoning system that learns as well as a person and can be applied to a variety of complex tasks. Such a system will significantly expand the kinds of tasks that a computer can learn.

Under the contract, which is administered by the Air Force Research Laboratory, Wright-Patterson AFB, Ohio, BBN's first year research will focus on military medical logistics planning, specifically, a simulation that requires evacuating wounded military personnel and civilians from Fallujah, Iraq to hospitals in Germany and Kuwait. However, successful demonstration of this system will have implications beyond the ability to automate the medical evacuation planning process by providing the groundwork for automated systems capable of learning other tasks of similar complexity.More: Read About BBN's HistoryWho were the private investors who bought BBN in March, 2004? That would be interesting to know.

posted by Kevin at 1:55 AM

Canadian Man Tortured by Mistake in "Breathtakingly Incompetent" Investigation

:.

Canadian police wrongly identified an Ottawa software engineer as an Islamic extremist, prompting U.S. agents to deport him to Syria, where he was tortured, an official inquiry concluded on Monday.

Maher Arar, who holds Canadian and Syrian nationality, was arrested in New York in September 2002 and accused of being an al-Qaeda member. In fact, said the judge who led the probe, all the signs point to the fact Arar was innocent.

Arar, 36, says he was repeatedly tortured in the year he spent in Damascus jails, and the inquiry agreed that he had been tortured. He was freed in 2003.

posted by Kevin at 12:45 AM

9/18/2006

UK: Mums Deliver Fast Food to Kids in School

:.

The whole damn show has gone insane. The parents who are doing this are as deranged as the school administrators who are getting government "officials" involved! I'd imagine that this would be like watching a brawl in a nuthouse: A group of mothers has started delivering fast food through a school's fence in protest at the campaign for healthier school meals.

The parents claim they are taking action because pupils are turning up their noses at what they describe as "overpriced, low-fat rubbish".

Four of them are using a supermarket trolley to make daily runs with fish and chips, pies, burgers, sandwiches and fizzy drinks from local takeaways.

Staff at Rawmarsh Comprehensive School, near Rotherham, South Yorkshire, have called in environmental health and education officials. They are looking into whether the women are allowed to sell food without an operating licence and whether they are covered by food hygiene regulations.

posted by Kevin at 8:05 PM

Jesus Camp Video Clip

:.

I thank God, each and every day, that I've been fortunate enough to be able to leave the United States. This clip reminds me of the Reevers in the Firefly series. Don't try to reason with them, don't try to fight them. Just run. Run for your life. Alas, Jesus Freak Crusaders (known as God Botherers in New Zealand) are showing up at our door, even out here. I've discussed with our neighbors various strategies for dealing with them. When we've been accosted, I try to let our neighbors know that the Jesus Freaks are minutes away. Our friends up the road release Angel, their Rhodesian Ridgeback (dog breed from South Africa used to hunt lions). Angel isn't interested in hearing the gospel according to these crackpots. We might have to start locking the gates to our properties. Becky considered a sign on our gate that read, "NO PROSELYTIZERS" right next to the one that says, "STRAY DOGS ON PROPERTY WILL BE SHOT" but her dad noted that, if challenged, the Jesus Freaks would say something like, "We're not Proselytizers, we're Jehovah's Witnesses." HAHAHAHA! None of this is meant to say that secular feminism, the other side presented in the clip, is some sort of sane perspective, which is just big government and social engineering under a different name. The reactionary elements to "Christian" America are AS NUTS OR NUTTIER than the Jesus Freaks. They're also proselytizers and fascists, but fortunately or not, they're too stoned and disorganized to accomplish much. The Jesus Freaks "have God on their side," so that seems to be a better motivator than the empty materialism and vanity whims of urban liberals. Given these choices, I pick neither. Have a nice day, America.

posted by Kevin at 7:03 PM

Schneier: Renew Your Passport Now

:.

If you have a passport, now is the time to renew it -- even if it's not set to expire anytime soon. If you don't have a passport and think you might need one, now is the time to get it. In many countries, including the United States, passports will soon be equipped with RFID chips. And you don't want one of these chips in your passport.

RFID stands for "radio-frequency identification." Passports with RFID chips store an electronic copy of the passport information: your name, a digitized picture, etc. And in the future, the chip might store fingerprints or digital visas from various countries.

By itself, this is no problem. But RFID chips don't have to be plugged in to a reader to operate. Like the chips used for automatic toll collection on roads or automatic fare collection on subways, these chips operate via proximity. The risk to you is the possibility of surreptitious access: Your passport information might be read without your knowledge or consent by a government trying to track your movements, a criminal trying to steal your identity or someone just curious about your citizenship.

At first the State Department belittled those risks, but in response to criticism from experts it has implemented some security features. Passports will come with a shielded cover, making it much harder to read the chip when the passport is closed. And there are now access-control and encryption mechanisms, making it much harder for an unauthorized reader to collect, understand and alter the data.

Although those measures help, they don't go far enough. The shielding does no good when the passport is open. Travel abroad and you'll notice how often you have to show your passport: at hotels, banks, Internet cafes. Anyone intent on harvesting passport data could set up a reader at one of those places. And although the State Department insists that the chip can be read only by a reader that is inches away, the chips have been read from many feet away.

The other security mechanisms are also vulnerable, and several security researchers have already discovered flaws. One found that he could identify individual chips via unique characteristics of the radio transmissions. Another successfully cloned a chip. The State Department called this a "meaningless stunt," pointing out that the researcher could not read or change the data. But the researcher spent only two weeks trying; the security of your passport has to be strong enough to last 10 years.

posted by Kevin at 6:48 PM

Weird Alternative Energy Idea

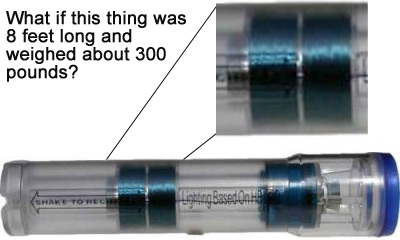

Our property gets a fair amount of wind, but it comes in gusts and swirls around in different directions because of the rolling topography and many tall trees. In short, this makes our site less than ideal for traditional wind power. But when the wind blows, I still think of getting electricity from it. Is there an outside-of-the-box-way of harnessing all this power? For a few weeks, I've been thinking that I needed the equivalent of a full wave rectifier for the wind. As I was doing the dishes yesterday, I looked out the window at a tall eucalyptus tree. I noticed that the wind was causing the top portion of the tree to sway back and forth, like a large metronome. "Add a rope to the top of that and there's my rectifier." Stay with me... The other night, our power went out [again---welcome to the Far North of New Zealand]. I grabbed my trusty LED shake light, gave it a few shakes and turned it on. The generator in this flashlight is small, but it's the idea that counts. Why don't we use it more often to increase our independence from criminal energy corporations?  Here it is: Tie a long rope to the top of that tall eucalyptus tree. From the rope, suspend a big permanent magnet. Surround the magnet with a big, stationary copper coil. Arrange the thing so that when the top of the tree oscillates in the wind, the magnet moves up and down through the coil. On the one hand, it seemed like a new and weird generator idea, but on the other hand, it seemed like deja vu... It took me a minute to remember where I'd seen this before. While I was spacing out, looking at that tree blowing in the wind, an echo of a story I'd read long ago must have somehow registered: permanent magnet linear generator buoy. This idea of mine is a land based permanent magnet linear generator. Instead of the rising and falling swell of the ocean, the massive, swaying tree would drive the generator. In the above article, flip the diagram upside down and tie the mooring cable to the top of one of my hundred foot tall trees. Here's a 1 minute hack job visual aid:  Now, how much juice would, say, a 100 pound magnet, moving through, say, 200 pounds of copper coil generate? A lot, is my guess. Maybe it would be better to use a mechanism like a free wheel from an old bicycle to crank a generator rotor. That would only work on the "recoil" phase of the tree... unless you had two generators... Hmm. I don't know the answer to questions like these. I read spy novels during my highschool physics class. I wish I'd paid more attention now. If you build one of these, please let me know how it goes.

posted by Kevin at 4:56 AM

9/17/2006

What Are Cryptogon Readers Ordering from Amazon?

:.

As usual, Cryptogon readers are selecting some pretty interesting goods on Amazon. Thanks to everyone who remembers to order their stuff via Cryptogon!

posted by Kevin at 1:37 AM

Virginia Teen Improving on Alternative Therapy

:.

A Virginia teenage cancer patient appears to be improving less than a month after he won a court fight to forgo chemotherapy and seek alternative treatments, his doctor said Friday.

"His tumor is shrinking very nicely and he's gaining energy and stamina," said Dr. Arnold Smith, medical director and radiation oncologist at the North Central Mississippi Regional Cancer Center in Greenwood.Research Credit: EG

posted by Kevin at 12:39 AM

Surveillance Cameras Now Bark Orders at Brits

:.

Big Brother is not only watching you - now he's barking orders too. Britain's first 'talking' CCTV cameras have arrived, publicly berating bad behaviour and shaming offenders into acting more responsibly.

The system allows control room operators who spot any anti-social acts - from dropping litter to late-night brawls - to send out a verbal warning: 'We are watching you'.

posted by Kevin at 12:34 AM

|

:. Reading

Fatal

Harvest: The Tragedy of Industrial Agriculture by Andrew Kimbrell

Readers will come to see

that industrial food production is indeed a "fatal harvest"

- fatal to consumers, as pesticide residues and new disease vectors

such as E. coli and "mad cow disease" find their way

into our food supply; fatal to our landscapes, as chemical runoff

from factory farms poison our rivers and groundwater; fatal to

genetic diversity, as farmers rely increasingly on high-yield

monocultures and genetically engineered crops; and fatal to our

farm communities, which are wiped out by huge corporate

farms. Fatal

Harvest: The Tragedy of Industrial Agriculture by Andrew Kimbrell

Readers will come to see

that industrial food production is indeed a "fatal harvest"

- fatal to consumers, as pesticide residues and new disease vectors

such as E. coli and "mad cow disease" find their way

into our food supply; fatal to our landscapes, as chemical runoff

from factory farms poison our rivers and groundwater; fatal to

genetic diversity, as farmers rely increasingly on high-yield

monocultures and genetically engineered crops; and fatal to our

farm communities, which are wiped out by huge corporate

farms.

Friendly

Fascism: The New Face of Power in America by Bertram Myron Gross

This is a relatively

short but extremely cogent and well-argued treatise on the rise

of a form of fascistic thought and social politics in late 20th

century America. Author Bertram Gross' thesis is quite straightforward;

the power elite that comprises the corporate, governmental and

military superstructure of the country is increasingly inclined

to employ every element in their formidable arsenal of 'friendly

persuasion' to win the hearts and minds of ordinary Americans

through what Gross refers to as friendly fascism. Friendly

Fascism: The New Face of Power in America by Bertram Myron Gross

This is a relatively

short but extremely cogent and well-argued treatise on the rise

of a form of fascistic thought and social politics in late 20th

century America. Author Bertram Gross' thesis is quite straightforward;

the power elite that comprises the corporate, governmental and

military superstructure of the country is increasingly inclined

to employ every element in their formidable arsenal of 'friendly

persuasion' to win the hearts and minds of ordinary Americans

through what Gross refers to as friendly fascism.

The

Good Life The

Good Life

by Scott and Helen Nearing Helen

and Scott Nearing are the great-grandparents of the back-to-the-land

movement, having abandoned the city in 1932 for a rural life based

on self-reliance, good health, and a minimum of cash...Fascinating,

timely, and wholly useful, a mix of the Nearings' challenging

philosophy and expert counsel on practical skills.

Silent

Theft: The Private Plunder of Our Common Wealth by David Bollierd

In Silent Theft, David Bollier

argues that a great untold story of our time is the staggering

privatization and abuse of our common wealth. Corporations are

engaged in a relentless plunder of dozens of resources that we

collectively own—publicly funded medical breakthroughs,

software innovation, the airwaves, the public domain of creative

works, and even the DNA of plants, animals and humans. Too often,

however, our government turns a blind eye—or sometimes helps

give away our assets. Amazingly,

the silent theft of our shared wealth has gone largely unnoticed

because we have lost our ability to see the commons. Silent

Theft: The Private Plunder of Our Common Wealth by David Bollierd

In Silent Theft, David Bollier

argues that a great untold story of our time is the staggering

privatization and abuse of our common wealth. Corporations are

engaged in a relentless plunder of dozens of resources that we

collectively own—publicly funded medical breakthroughs,

software innovation, the airwaves, the public domain of creative

works, and even the DNA of plants, animals and humans. Too often,

however, our government turns a blind eye—or sometimes helps

give away our assets. Amazingly,

the silent theft of our shared wealth has gone largely unnoticed

because we have lost our ability to see the commons.

The

Self-Sufficient Life and How to Live It: The Complete Back-To-Basics

Guide by John Seymour The

Self Sufficient Life and How to Live It is the only book that

teaches all the skills needed to live independently in harmony

with the land harnessing natural forms of energy, raising crops

and keeping livestock, preserving foodstuffs, making beer and

wine, basketry, carpentry, weaving, and much more. The

Self-Sufficient Life and How to Live It: The Complete Back-To-Basics

Guide by John Seymour The

Self Sufficient Life and How to Live It is the only book that

teaches all the skills needed to live independently in harmony

with the land harnessing natural forms of energy, raising crops

and keeping livestock, preserving foodstuffs, making beer and

wine, basketry, carpentry, weaving, and much more.

When

Corporations Rule the World by David C. Korten

When Corporations

Rule the World explains how economic globalization has concentrated

the power to govern in global corporations and financial markets

and detached them from accountability to the human interest. It

documents the devastating human and environmental consequences

of the successful efforts of these corporations to reconstruct

values and institutions everywhere on the planet to serve their

own narrow ends. When

Corporations Rule the World by David C. Korten

When Corporations

Rule the World explains how economic globalization has concentrated

the power to govern in global corporations and financial markets

and detached them from accountability to the human interest. It

documents the devastating human and environmental consequences

of the successful efforts of these corporations to reconstruct

values and institutions everywhere on the planet to serve their

own narrow ends.

The

New Organic Grower: A Master's Manual of Tools and Techniques

for the Home and Market Gardener

This expansion

of a now-classic guide originally published in 1989 is intended

for the serious gardener or small-scale market farmer. It describes

practical and sustainable ways of growing superb organic vegetables,

with detailed coverage of scale and capital, marketing, livestock,

the winter garden, soil fertility, weeds, and many other

topics. The

New Organic Grower: A Master's Manual of Tools and Techniques

for the Home and Market Gardener

This expansion

of a now-classic guide originally published in 1989 is intended

for the serious gardener or small-scale market farmer. It describes

practical and sustainable ways of growing superb organic vegetables,

with detailed coverage of scale and capital, marketing, livestock,

the winter garden, soil fertility, weeds, and many other

topics.

|