|

7/29/2006

The Them: Interlocking Directorates and Political Cohesion Among Corporate Elites

:.

Our reality is shaped by a handfull of people who share similar world views and have the ability to allocate resources to values. Say 'hello' to The Them: When we consider that, on average, the top officers of large corporations are linked to roughly a third of all other top officers of large corporations through chains of interlocking directorships of no more than four or five links, and that linkages of this distance are significantly associated with similarity of political behavior, then the thesis that interlocking directorships enhance the potential for political cohesion across the entire big business community becomes more persuasive. Remember also that this includes only links that are created through corporate boards, ignoring the numerous ties created through noncorporate boards, not to mention social ties of various kinds.

...

As this study shows, social ties among actors have significant consequences for political action that go beyond anything that can be explained in terms of attributes measured at the level of the individual actor. The study thus speaks to the merits of a structural perspective on political behavior and the importance of gathering and analyzing data not just on individual actors, but on the network of social ties among those actors.Read More About Them: interlocking boards directorship OR directors OR "directorship networks"Related: They Rule

posted by Kevin at 9:21 PM

Americans to be Detained Indefinitely and Barred from Access to Civilian Courts

:.

Will you be disappeared? Will your family know what happened to you? Will you allow yourself to be taken alive? All Americans need to think about these questions: U.S. citizens suspected of terror ties might be detained indefinitely and barred from access to civilian courts under legislation proposed by the Bush administration, say legal experts reviewing an early version of the bill.

A 32-page draft measure is intended to authorize the Pentagon's tribunal system, established shortly after the 2001 terrorist attacks to detain and prosecute detainees captured in the war on terror. The tribunal system was thrown out last month by the Supreme Court.

According to the draft, the military would be allowed to detain all "enemy combatants" until hostilities cease. The bill defines enemy combatants as anyone "engaged in hostilities against the United States or its coalition partners who has committed an act that violates the law of war and this statute."

Legal experts said Friday that such language is dangerously broad and could authorize the military to detain indefinitely U.S. citizens who had only tenuous ties to terror networks like al Qaeda.

"That's the big question ... the definition of who can be detained," said Martin Lederman, a law professor at Georgetown University who posted a copy of the bill to a Web blog.

Scott L. Silliman, a retired Air Force Judge Advocate, said the broad definition of enemy combatants is alarming because a U.S. citizen loosely suspected of terror ties would lose access to a civilian court - and all the rights that come with it.

Administration officials have said they want to establish a secret court to try enemy combatants that factor in realities of the battlefield and would protect classified information.

posted by Kevin at 6:46 PM

Israel Created Worst Ever Environmental Disaster in Mediterranean

:.

Who are the terrorists? The Mediterranean is threatened by its worst ever environmental disaster after Israel's bombing of a power plant in Lebanon sent thousands of tonnes of fuel gushing into the sea, the environment minister charged.

"Up until now 10,000-15,000 tonnes of heavy fuel oil have spilled out into the sea," after Israel's bombing of the power station in Jiyeh two weeks ago, Lebanese Environment Minister Yacub Sarraf told AFP Saturday.

"It's without doubt the biggest environmental catastrophe that the Mediterranean has known and it risks having terrible consequences not only for our country but for all the countries of the eastern Mediterranean."

Israeli forces bombed the tanks at the power station on July 14 and July 15, just days into their offensive on Lebanon which has seen blistering air strikes across the country and a bloody ground incursion in the south.

The leak from one of the tanks, which are located just 25 metres (80 feet) from the sea, has now stopped but another containing 25,000 tonnes of fuel oil is still on fire and is in danger of exploding. Between 8,000-10,000 tonnes of fuel are on the shore and 5,000 on the open water.

posted by Kevin at 3:24 PM

7/28/2006

Activists Elect Cops to Leadership Roles in Anti War Group

:.

Two Oakland police officers working undercover at an anti-war protest in May 2003 got themselves elected to leadership positions in an effort to influence the demonstration, documents released Thursday show.

The department assigned the officers to join activists protesting the U.S. war in Iraq and the tactics that police had used at a demonstration a month earlier, a police official said last year in a sworn deposition.

At the first demonstration, police fired nonlethal bullets and bean bags at demonstrators who blocked the Port of Oakland's entrance in a protest against two shipping companies they said were helping the war effort. Dozens of activists and longshoremen on their way to work suffered injuries ranging from welts to broken bones and have won nearly $2 million in legal settlements from the city. More: Political Activism and the American Corporate StateHere's more information on activism from my essay, Militant Electronic Piracy: Non-Violent Insurgency Tactics Against the American Corporate State: Political Activism and the American Corporate State (ACS) Counterinsurgency Apparatus

The ACS employs a full time counterinsurgency infrastructure with resources that are unimaginable to most would be insurgents. Quite simply, violent insurgents have no idea of just how powerful the foe actually is. Violent insurgents typically start out as peaceful, idealistic, political activists. Whether or not political activists know it, even with very mundane levels of political activity, they are engaging in low intensity conflict with the ACS.

The U.S. military classifies political activism as "low intensity conflict." The scale of warfare (in terms of intensity) begins with individuals distributing anti-government handbills and public gatherings with anti-government/anti-corporate themes. In the middle of the conflict intensity scale are what the military refers to as Operations Other than War; an example would be the situation the U.S. is facing in Iraq. At the upper right hand side of the graph is global thermonuclear war. What is important to remember is that the military is concerned with ALL points along this scale because they represent different types of threats to the ACS.

Making distinctions between civilian law enforcement and military forces, and foreign and domestic intelligence services is no longer necessary. After September 11, 2001, all national security assets would be brought to bare against any U.S. insurgency movement. Additionally, the U.S. military established NORTHCOM which designated the U.S. as an active military operational area. Crimes involving the loss of corporate profits will increasingly be treated as acts of terrorism and could garner anything from a local law enforcement response to activation of regular military forces.

Most of what is commonly referred to as "political activism" is viewed by the corporate state's counterinsurgency apparatus as a useful and necessary component of political control.

Letters-to-the-editor...

Calls-to-elected-representatives...

Waving banners...

"Third" party political activities...

Taking beatings, rubber bullets and tear gas from riot police in free speech zones...

Political activism amounts to an utterly useless waste of time, in terms of tangible power, which is all the ACS understands. Political activism is a cruel guise that is sold to people who are dissatisfied, but who have no concept of the nature of tangible power. Counterinsurgency teams routinely monitor these activities, attend the meetings, join the groups and take on leadership roles in the organizations.

It's only a matter of time before some individuals determine that political activism is a honeypot that accomplishes nothing and wastes their time. The corporate state knows that some small percentage of the peaceful, idealistic, political activists will eventually figure out the game. At this point, the clued-in activists will probably do one of two things; drop out or move to escalate the struggle in other ways.

If the clued-in activist drops his or her political activities, the ACS wins.

But what if the clued-in activist refuses to give up the struggle? Feeling powerless, desperation could set in and these individuals might become increasingly radicalized. Because the corporate state's counterinsurgency operatives have infiltrated most political activism groups, the radicalized members will be easily identified, monitored and eventually compromised/turned, arrested or executed. The ACS wins again.

Footnote 4 Low Intensity Warfare represents a nexus of insurgency, counterinsurgency and psychological operations. Detailing this massive area of inquiry is far beyond the scope of this essay. Some useful materials are: U.S. Army Field Manual FM 100-20, Military Operations in Low Intensity Conflict; documents on the Information Warfare PSYOP site; and Low-intensity Operations: Subversion, Insurgency and Peacekeeping by General Sir Frank Kitson. Additionally, all activists must read Endgame: Volume 1: The Problem of Civilization and Endgame: Volume 2: Resistance, both by Derrick Jensen. The publisher has sent me both of these books for review and I am currently digesting them. I have, however, read enough of them to know that ALL activists must read them and confront Jensen's argument.

posted by Kevin at 5:15 PM

California: Apocalypse Now

:.

CORPSES piled up in mortuaries yesterday as the death toll for California's record-breaking heat wave rose above 120.

After nearly two weeks, during which temperatures have regularly exceeded 49C (120F), the state was taking emergency measures to stem fatalities.

...

In the mortuary at Fresno County the walk-in freezer was packed with bodies, with some piled on top of others, said Loralee Cervantes, the Coroner. With limited air conditioning, employees worked in sweltering heat as the coroner's office investigated at least 22 possible heat-related deaths. "It's never been like this in my years here," Ms Cervantes said. "This is really tragic."

The heat also brought with it wildfires and blackouts for millions, with the state's electricity grid coming close to meltdown as reserves dropped below 5 per cent.

...

Humans were not the only ones to suffer. According to California Dairies, the heat killed 16,500 cows or 1 per cent of the state's dairy herd. Cows do not have sweat glands and produce less milk when they are overheated.

As a result milk production has been down by up to 20 per cent. Under normal circumstances California produces more milk than any other state, providing about 12 per cent of the country's supply.

Among the 123 fatalities so far were a 38-year-old farm worker found in a field; an unidentified man who got himself to a hospital emergency room where his body temperature was 109.9F, and a 58-year-old man who had been drinking. The youngest casualty of the heat was 20, the oldest 95.

posted by Kevin at 4:05 PM

Israeli PSYOP Mobs Unleashed

:.

WHILE Israel fights Hezbollah with tanks and aircraft, its supporters are campaigning on the internet.

Israel's Government has thrown its weight behind efforts by supporters to counter what it believes to be negative bias and a tide of pro-Arab propaganda. The Foreign Ministry has ordered trainee diplomats to track websites and chatrooms so that networks of US and European groups with hundreds of thousands of Jewish activists can place supportive messages.

In the past week nearly 5,000 members of the World Union of Jewish Students (WUJS) have downloaded special "megaphone" software that alerts them to anti-Israeli chatrooms or internet polls to enable them to post contrary viewpoints. A student team in Jerusalem combs the web in a host of different languages to flag the sites so that those who have signed up can influence an opinion survey or the course of a debate.

posted by Kevin at 4:01 PM

"In One Hour We Will Blow Up Your House"

:.

The voice sounded friendly enough. "Hi, my name is Danny. I'm an officer in Israeli military intelligence. In one hour we will blow up your house."

Mohammed Deeb took the telephone call seriously and told his family and neighbours to get out of the building. An hour later, an Israeli helicopter fired three missiles at the four-storey building in Gaza City, destroying the ground floor and damaging the upper storeys.

Mr Deeb was on the receiving end of a new Israeli tactic of using telephone, radio and leaflets to warn Gazans of impending attacks. The army claims it is an attempt to minimise civilian casualties, but Palestinians say it is a new way of terrorising the population.

posted by Kevin at 3:56 PM

Could U.S. Troops End Up in Lebanon?

:.

There's much discussion of putting a multinational, NATO-led force in southern Lebanon as part of a ceasefire agreement in the Israel-Lebanon conflict, but Secretary of State Condoleezza Rice, according to a story in the Washington Post, has said that she does "not think that it is anticipated that U.S. ground forces... are expected for that force." However, a well-connected former CIA officer has told me that the Bush Administration is in fact considering exactly such a deployment.

posted by Kevin at 4:55 AM

7/27/2006

Gold Behaving Again

:.

They don't want to make it easy for you. But then again, nobody said it was going to be easy: Gold prices jumped nearly two percent to one-week highs in Europe on Thursday, supported by weakness in the dollar, firm oil and the Middle East tension.

The precious metal hit a session high of $633.90 an ounce, the highest since July 21. It has climbed more than five percent from a three-week low of $601.60 reached on Monday.

"The dollar and oil are causing the move higher. A couple of weeks ago, it had broken away from the dollar moves but now it seems to be back in line again," said a precious metals trader in London.

posted by Kevin at 4:44 AM

7/26/2006

WalMart Is Clean and Green, Don'tcha Know?

:.

Oh sure, why not? It'll be Walmart, " organic" freedom fries and fair trade coffee from McDonald's inside the domed cities, the only places left on Earth where humans will be able to survive. The rest of the surface of the planet will be a moonscape. Don't worry, there will be "free speech zones" in the domed cities where activists (arrving in fuelcell SUVs, corn Jettas and fart scooters) can wave their signs: The retailing giant is placing bets on an environmentally friendly future.Related: Walmart DungeonRelated: The National Animal Identification System: A Brave and Terrifying New World

posted by Kevin at 2:51 PM

Judge Throws Out ATT/NSA Case

:.

Imagine my shock: "The court is persuaded that requiring AT&T to confirm or deny whether it has disclosed large quantities of telephone records to the federal government could give adversaries of this country valuable insight into the government's intelligence activities," U.S. District Judge Matthew F. Kennelly said.

posted by Kevin at 3:42 AM

Orange County Foreclosures Nearly Double

:.

HAHAHA! This is the place Becky and I fled, the place I grew up. Jesus fish stickers on the SUVs, fake boobs, grass under renovation, jewel encrusted cell phones... The horror. The horror of that place... Choke on your dry-rotted, stuccobox McMansions and re-fi one last time to pay your bankruptcy lawyers! Orange County's foreclosures nearly doubled in June, rising to 65 property sales from 35 in May, according to RealtyTrac Inc.'s monthly foreclosure report.

Overall, foreclosure activity, including default warnings to delinquent homeowners, was up 60 percent last month, the report shows.

The county had 639 new foreclosure filings last month, up from 399 in May, RealtyTrac reported. That includes 574 default notices issued to homeowners behind in their monthly loan payments.

Orange County's increase in foreclosure activity was the highest in the area. Los Angeles County's activity was up 15.7 percent; Riverside County's was up 25 percent; and San Bernardino County's was up 11.7 percent, RealtyTrac reported.

posted by Kevin at 12:27 AM

7/25/2006

Ford Trying to Get a Clue?

I routinely look at Cryptogon's logs to find out who is looking for what. I especially liked this one: A Ford Motor Company user (host: ncfmcc1-ext.nb.ford.com, ip: 136.2.1.101) conducted the following Google search: tesla motors roadster. HAHA. Wake up, you dolts! Related: Ford Reports $123 Million Loss

posted by Kevin at 3:45 PM

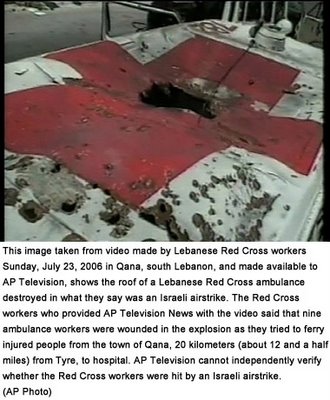

ISRAELI ATROCITIES: LEBANESE AMBULANCES ATTACKED

:.

The ambulance headlamps were on, the blue light overhead was flashing, and another light illuminated the Red Cross flag when the first Israeli missile hit, shearing off the right leg of the man on the stretcher inside. As he lay screaming beneath fire and smoke, patients and ambulance workers scrambled for safety, crawling over glass in the dark. Then another missile hit the second ambulance. The ambulance headlamps were on, the blue light overhead was flashing, and another light illuminated the Red Cross flag when the first Israeli missile hit, shearing off the right leg of the man on the stretcher inside. As he lay screaming beneath fire and smoke, patients and ambulance workers scrambled for safety, crawling over glass in the dark. Then another missile hit the second ambulance.

Even in a war which has turned the roads of south Lebanon into killing zones, Israel's rocket strike on two clearly marked Red Cross ambulances on Sunday night set a deadly new milestone.

Six ambulance workers were wounded and three generations of the Fawaz family, being transported to hospital from Tibnin with what were originally minor injuries, were left fighting for their lives. Two ambulances were entirely destroyed, their roofs pierced by missiles.

The Lebanese Red Cross, whose ambulance service for south Lebanon is run entirely by volunteers, immediately announced it would cease all rescue missions unless Israel guaranteed their safety through the United Nations or the International Red Cross.

posted by Kevin at 3:15 PM

U.S. Air Marshals: Innocent People Placed On 'Watch List' to Meet Quota

:.

Welcome to the Soviet Union: You could be on a secret government database or watch list for simply taking a picture on an airplane. Some federal air marshals say they're reporting your actions to meet a quota, even though some top officials deny it.

The air marshals, whose identities are being concealed, told 7NEWS that they're required to submit at least one report a month. If they don't, there's no raise, no bonus, no awards and no special assignments.

"Innocent passengers are being entered into an international intelligence database as suspicious persons, acting in a suspicious manner on an aircraft ... and they did nothing wrong," said one federal air marshal.

These unknowing passengers who are doing nothing wrong are landing in a secret government document called a Surveillance Detection Report, or SDR. Air marshals told 7NEWS that managers in Las Vegas created and continue to maintain this potentially dangerous quota system.

posted by Kevin at 3:04 PM

The O'Connor Hush Turbine

:.

Cool design for a wind turbine.

posted by Kevin at 2:32 AM

Teen Forced to Take Deadly Cancer Treatment

:.

They hate us for our freedom: A 16-year-old cancer patient was headed to court Tuesday with his lawyers to try to block a judge's order requiring him to report to a hospital the same day for treatment as doctors deem necessary.

posted by Kevin at 1:21 AM

Fleeing Civilian Vehicles Hit by Israeli Missiles

:.

WITH an expression of utmost calm on her blood-masked face, the woman allowed herself to be gently lowered from the minibus into the waiting arms of two Lebanese Red Cross volunteers.

The rescue workers had extracted her through a jagged hole in the roof of the crumpled bus, created by a missile fired minutes earlier by an Israeli helicopter that had blasted the vehicle off the road. Left behind in the vehicle, slumped over each other and soaked in blood, were the bodies of three people.

The narrow roads that meander through the valleys and undulating chalky hills east of Tyre were a place of terror and death yesterday as Israeli helicopters attacked civilian vehicles fleeing Israel’s 11-day onslaught in south Lebanon.

posted by Kevin at 1:18 AM

7/24/2006

Cryptogon Open Source Intelligence Service

An open source intelligence service is now available to Cryptogon readers. For a fee of US$50 per week, I will actively monitor, research and collate information on any area of inquiry that you specify. You will have access to a password protected web site that is dedicated to your open source intelligence product. You may monitor developments by logging into the site or via RSS news feed. Initially, this service will only be available to three clients. As a Cryptogon reader, you already know the value of open source intelligence. Why not put my skills to use on your project, issue or case? Obviously, all information related to this service will be kept strictly confidential. Upon termination of the service, your private website and all information associated with it will be deleted. If you are interested, please send an email with a detailed description of your needs to:  If you require encryption, please use the above email address with the following public key: -----BEGIN PGP PUBLIC KEY BLOCK----- Version: GnuPG v1.4.4 (MingW32) mQGiBETAoMkRBAC0I5L0oam+yRp8lyP0x7SBHnwhDFSCTxdc17W+MynTnJM1+sYt DHCPD+1q/fXY7cQATQc7nc5nMNAcKvvO458JICQgqA95eh4BUMe2AETnGE04KQdC J+hcF2TcB7LPgA8mF6n2PMjOeiT6ZSKsaR7RvA2IsKu3NAZMB7Bmk1rPWwCgxv4p zMjm5AE85MJsyZUyLWIgH+8D+QHjGpXiYw3iLgNIfsNmtOkOq8BRi/7S9WQ/pN2W d0WdoiQqrfB6ftpm/33+0u8SkSRJT4DRTrP6qClT3gdMRu5gXZ/jbUmWUOrydv5E gzPRxVP6ygJz4Mrf62SBY0he//2MeY71Gc4gbtXh/996OwpGQD8jvQ7ifMOwhONB jMYwA/9j8TurHpSTg4qdMMbRps/8gFgx1vcIkld2vSKTWQplhH3O0Y6ZHj7nSs+x HqTvM7eozkPJHga6aYsKw04MaBjT7InoX/pc4I2B2ZzFNwFAvIM59Y2lKhkEBKPY 4X0FSqU4fzpUn0XumFbTSkPLv4IrT/FrxsDxJtb1FrLF2YBXbbQkS2V2aW4gRmxh aGVydHkgPG9zaW50QGNyeXB0b2dvbi5jb20+iGYEExECACYFAkTAoMkCGyMFCQlm AYAGCwkIBwMCBBUCCAMEFgIDAQIeAQIXgAAKCRABZSfnEIBOY7sYAKCsPF0nXyKB T5/mcnb+6Sjt6a07UwCgwWsaDIZM3yScobk/o9bPSCkBhi65Ag0ERMCg3hAIANQQ DKVLCgabgz2IEXyg8wjInTAi/NH9HIYfQUu4cWj1NjMj7sPE0Z5OqnCkNz4zqv3S JiPbx/8zj/jqGSpx43Kh5ZGugBbj9SfNUYxPh/FjXc+4VoR4cn+nH2hSS34xk3F4 tfgkB09dNO9f88PJJIsgMFXMWPYr7NzZMw9DbqdlndbpmYf20uLaMUrkn+QY6uIr AJg0FtDznCiGTAXnWO0YLobiDE4sRoMkZsGPstKkPRrR0cpNmhwP3FnKEJF7lfb7 jpUFaQF21qy30o6g2gd/saChBjQ7Gj5SnuJgP+xHPVe8XRsFj2y+fCBuI2hoSImg z1Rcdzl+ADdcm9DyOYsAAwUH/2tWgYVzIjl6LCciRmas1bWqbMKr2uuOFBAaew0n T+e3SaAxMq2+sYovkgnMU+3JNCh9wBt4pghXRAmdZBvqF7Jck7njxY/Gbr7EwJo+ XDcnjTxaR1p6g655gUugShxfmxWcNH1Zxlry5v1aGkd04YTfEPNOwQ21EmKz+PIm 0kpIYnDRUBcEY4xCcFLHCYPo+Ffyp3GaRg9g0Qwkz3WXtsSJQ6lHuUcsTVU3eYLk On5+C8SVNVRYi3Kn/Rrs2VHNvVvtDY//r5uBqGJRh6iphhjN5sOTaPlLFkOmkzXS hIVPcTYHLwe1jFWKemQnY5hgxjvdwJ54dO41hJBRoW653uqITwQYEQIADwUCRMCg 3gIbDAUJCWYBgAAKCRABZSfnEIBOY36JAJ9HI3Rlu+lRWXL81zq9oW/3M64DowCf UQvqBeRBxdG+uYaj7Lsjt0JpdtE= =8aec -----END PGP PUBLIC KEY BLOCK-----

posted by Kevin at 5:05 AM

Cryptogon Reader Contributes $10

BB sent $10 and wrote: Do the Baby Boomers a favor and determine where we should put our wad of dollars prior to the poop hitting the fan. Like you say; gold is a conundrum now. Best of luck in all your efforts! Maybe my response will be useful to some of you: Thanks for your contribution!

I can safely say that I have no for-sure strategies for preserving wealth in the face of the situation facing the U.S. and the world. Like I've said before, I don't think it's possible to get a grasp on the seriousness of this, a priori. If any of several different situations (financial, war/terror, energy, pandemic, weather/ecological) start to unwind, we won't be debating gold vs. silver vs. stocks vs. bonds vs. cash etc.

I'd be investing very close to home.

Is your landbase and community sorted out? Meaning, do you have good top soil and a reliable and clean water supply? Are you friends with your neighbors? Is everyone armed? They should be.

I would suggest using your money to get your land in the best shape possible, and to buy equipment and tools that will LAST for a long, long time.

While I don't think real estate makes sense anymore from the typical investment perspective, I think it MIGHT make sense IF you can own it outright and collect rent. What you're doing is trading your paper wealth for an income stream in the future. Forget about what's going to happen to the value of the property. Just forget that aspect for a moment, if you can. Unless we go to a Mad Max scenario (which could happen) there will still be owners and there will still be renters. Your U.S. dollar denominated paper assets may have long since become worthless, but you will still be collecting the coin of the realm (whatever that happens to be in the future) from your renters.

The old "don't put all your eggs in one basket" rule applies as much now as it ever did.

I, personally, wouldn't go near typical buy-and-hold investments; stocks, bonds, etc. If you feel as though you have to be in paper assets, you should be using advanced hedging techniques with options to mitigate risk. You'll be paying fixed amounts of money along the way (option expiration) to prevent potential disaster. People who were long Yahoo AND holding puts in the right ratio made out like bandits on the stock's collapse, while the regular retail investors got decapitated.

I don't see gold being a cure-all, but who knows!? It might go to ______ <- fill in the blank. Consider nibbling the dips under $600? That would be my best guess, if I was forced to make a guess.

Oil? It could just as easily go to $45 before it goes to $200. I wouldn't go near oil, long or short. It's far too volatile.

Real estate!? HAHAHA. Keep your powder dry and buy when blood is flowing in the streets. Pay cash for potential rental units that dumbsh*ts MUST sell at shocking discounts (from today's prices) to avoid bankruptcy. (If Becky and I had excess cash to deal with, which we don't, this would be our plan.) A lot of really nice apples are about to be shaken loose from the tree.

This might sound weird, but it must not be overlooked. Start up some kind of business or activity that involves young men. Look at the role of young men in any failed state. You will want to have these guys on your side when things get weird. Your life might depend on it.

Well, those are a few ideas to consider.

Best,

Kevin

posted by Kevin at 5:03 AM

7/23/2006

U.K. Government Approves Export of Dirty Bomb Components to Iranian Military

:.

Do you get it yet? Border guards seized a British lorry on its way to make a delivery to the Iranian military - after discovering it was packed with radioactive material that could be used to build a dirty bomb.

The lorry set off from Kent on its way to Tehran but was stopped by officials at a checkpoint on Bulgaria's northernborder with Romania after a scanner indicated radiation levels 200 times above normal.

The lorry was impounded and the Bulgarian Nuclear Regulatory Agency (NPA) was called out.

On board they found ten lead-lined boxes addressed to the Iranian Ministry of Defence. Inside each box was a soil-testing device, containing highly dangerous quantities of radioactive caesium 137 and americium-beryllium.

The soil testers had been sent to Iran by a British firm with the apparent export approval of the Department of Trade and Industry.

Last night, the head of the Bulgarian NRA, Nikolai Todorov, said he was shocked that devices containing so much nuclear material could be sold so easily.

posted by Kevin at 5:24 PM

|

:. Reading

Fatal

Harvest: The Tragedy of Industrial Agriculture by Andrew Kimbrell

Readers will come to see

that industrial food production is indeed a "fatal harvest"

- fatal to consumers, as pesticide residues and new disease vectors

such as E. coli and "mad cow disease" find their way

into our food supply; fatal to our landscapes, as chemical runoff

from factory farms poison our rivers and groundwater; fatal to

genetic diversity, as farmers rely increasingly on high-yield

monocultures and genetically engineered crops; and fatal to our

farm communities, which are wiped out by huge corporate

farms. Fatal

Harvest: The Tragedy of Industrial Agriculture by Andrew Kimbrell

Readers will come to see

that industrial food production is indeed a "fatal harvest"

- fatal to consumers, as pesticide residues and new disease vectors

such as E. coli and "mad cow disease" find their way

into our food supply; fatal to our landscapes, as chemical runoff

from factory farms poison our rivers and groundwater; fatal to

genetic diversity, as farmers rely increasingly on high-yield

monocultures and genetically engineered crops; and fatal to our

farm communities, which are wiped out by huge corporate

farms.

Friendly

Fascism: The New Face of Power in America by Bertram Myron Gross

This is a relatively

short but extremely cogent and well-argued treatise on the rise

of a form of fascistic thought and social politics in late 20th

century America. Author Bertram Gross' thesis is quite straightforward;

the power elite that comprises the corporate, governmental and

military superstructure of the country is increasingly inclined

to employ every element in their formidable arsenal of 'friendly

persuasion' to win the hearts and minds of ordinary Americans

through what Gross refers to as friendly fascism. Friendly

Fascism: The New Face of Power in America by Bertram Myron Gross

This is a relatively

short but extremely cogent and well-argued treatise on the rise

of a form of fascistic thought and social politics in late 20th

century America. Author Bertram Gross' thesis is quite straightforward;

the power elite that comprises the corporate, governmental and

military superstructure of the country is increasingly inclined

to employ every element in their formidable arsenal of 'friendly

persuasion' to win the hearts and minds of ordinary Americans

through what Gross refers to as friendly fascism.

The

Good Life The

Good Life

by Scott and Helen Nearing Helen

and Scott Nearing are the great-grandparents of the back-to-the-land

movement, having abandoned the city in 1932 for a rural life based

on self-reliance, good health, and a minimum of cash...Fascinating,

timely, and wholly useful, a mix of the Nearings' challenging

philosophy and expert counsel on practical skills.

Silent

Theft: The Private Plunder of Our Common Wealth by David Bollierd

In Silent Theft, David Bollier

argues that a great untold story of our time is the staggering

privatization and abuse of our common wealth. Corporations are

engaged in a relentless plunder of dozens of resources that we

collectively own—publicly funded medical breakthroughs,

software innovation, the airwaves, the public domain of creative

works, and even the DNA of plants, animals and humans. Too often,

however, our government turns a blind eye—or sometimes helps

give away our assets. Amazingly,

the silent theft of our shared wealth has gone largely unnoticed

because we have lost our ability to see the commons. Silent

Theft: The Private Plunder of Our Common Wealth by David Bollierd

In Silent Theft, David Bollier

argues that a great untold story of our time is the staggering

privatization and abuse of our common wealth. Corporations are

engaged in a relentless plunder of dozens of resources that we

collectively own—publicly funded medical breakthroughs,

software innovation, the airwaves, the public domain of creative

works, and even the DNA of plants, animals and humans. Too often,

however, our government turns a blind eye—or sometimes helps

give away our assets. Amazingly,

the silent theft of our shared wealth has gone largely unnoticed

because we have lost our ability to see the commons.

The

Self-Sufficient Life and How to Live It: The Complete Back-To-Basics

Guide by John Seymour The

Self Sufficient Life and How to Live It is the only book that

teaches all the skills needed to live independently in harmony

with the land harnessing natural forms of energy, raising crops

and keeping livestock, preserving foodstuffs, making beer and

wine, basketry, carpentry, weaving, and much more. The

Self-Sufficient Life and How to Live It: The Complete Back-To-Basics

Guide by John Seymour The

Self Sufficient Life and How to Live It is the only book that

teaches all the skills needed to live independently in harmony

with the land harnessing natural forms of energy, raising crops

and keeping livestock, preserving foodstuffs, making beer and

wine, basketry, carpentry, weaving, and much more.

When

Corporations Rule the World by David C. Korten

When Corporations

Rule the World explains how economic globalization has concentrated

the power to govern in global corporations and financial markets

and detached them from accountability to the human interest. It

documents the devastating human and environmental consequences

of the successful efforts of these corporations to reconstruct

values and institutions everywhere on the planet to serve their

own narrow ends. When

Corporations Rule the World by David C. Korten

When Corporations

Rule the World explains how economic globalization has concentrated

the power to govern in global corporations and financial markets

and detached them from accountability to the human interest. It

documents the devastating human and environmental consequences

of the successful efforts of these corporations to reconstruct

values and institutions everywhere on the planet to serve their

own narrow ends.

The

New Organic Grower: A Master's Manual of Tools and Techniques

for the Home and Market Gardener

This expansion

of a now-classic guide originally published in 1989 is intended

for the serious gardener or small-scale market farmer. It describes

practical and sustainable ways of growing superb organic vegetables,

with detailed coverage of scale and capital, marketing, livestock,

the winter garden, soil fertility, weeds, and many other

topics. The

New Organic Grower: A Master's Manual of Tools and Techniques

for the Home and Market Gardener

This expansion

of a now-classic guide originally published in 1989 is intended

for the serious gardener or small-scale market farmer. It describes

practical and sustainable ways of growing superb organic vegetables,

with detailed coverage of scale and capital, marketing, livestock,

the winter garden, soil fertility, weeds, and many other

topics.

|