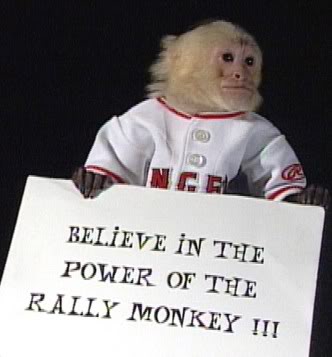

Confetti Schredder Rally Time

May 10th, 2010UPDATE: FEDERAL RESERVE OPENS EMERGENCY CREDIT LINE TO EUROPE

Via: AP:

The Federal Reserve late Sunday opened a program to ship U.S. dollars to Europe in a move to head off a broader financial crisis on the continent.

Other central banks, including the Bank of Canada, the Bank of England, the European Central Bank, the Swiss National Bank and the Bank of Japan also are involved in the dollar swap effort.

The move comes after the European Union and International Monetary Fund pledged a nearly $1 trillion defense package for the embattled euro, hoping to calm jittery markets and halt attacks on the eurozone’s weakest members. The ECB also jumped into the bond market Sunday night, saying it is ready to buy eurozone bonds to shore up liquidity in “dysfunctional” markets.

The Fed’s action reopens a program put in place during the 2008 global financial crisis under which dollars are shipped overseas through the foreign central banks. In turn, these central banks can lend the dollars out to banks in their home countries that are in need of dollar funding to prevent the European crisis from spreading further.

The Fed said action is being taken “in response to the reemergence of strains in U.S. dollar short-term funding markets in Europe,” and to prevent the spread of that strain to other markets and financial centers.

A so-called “swap” line with the Bank of Canada provides up to $30 billion. Figures weren’t provided for the other central banks. The arrangements are authorized through January 2011.

—End Update—

WEEEE!

European markets are up over 4% right now.

U.S. futures sharply higher…

The only question now is: Who got filled around zero last week? This thing is a scam wrapped inside a swindle.